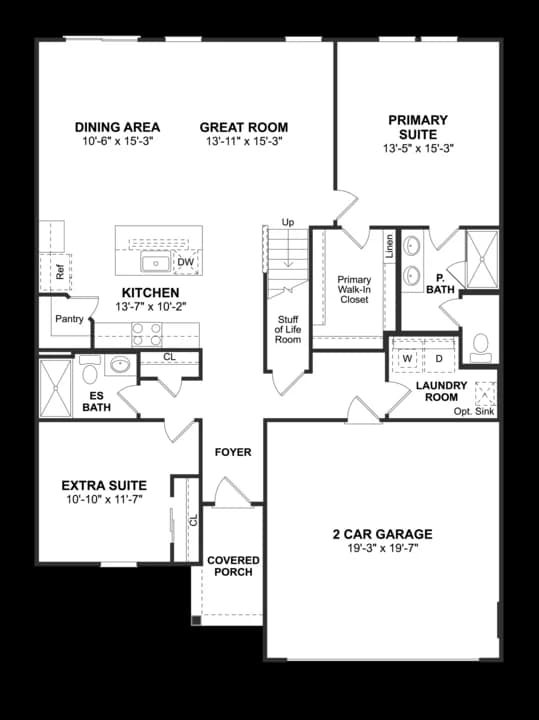

Prices, availability, and specifications may change without notice. Lot and view premiums may apply, and availability is not guaranteed. This site makes use of licensed stock photography, artist renderings and may use artificial intelligence. Some photography and artist renderings may be used for illustrative purposes and contain structural options, furnishings or designer features that are not included as standard. Certain materials may be discontinued or substituted. Room dimensions may vary. Please see a community Sales Consultant to learn how you can personalize your new home with optional features and upgrades. Amenity offerings may vary by community. Financial incentives including but not limited to rate buy downs, builder forward commitments (BFCs), special fixed interest rates and flex cash offerings are limited and may be discontinued without prior notice. Please speak with a community Sales Consultant for details.

**Conventional 7/6 Adjustable Rate Mortgage ("ARM") Interest Rate starting at 3.75% (5.162% APR) (“Promotion”) valid on new home contracts entered as of 2/9/26-3/31/26 (“Promotion Period”) on select eligible Quick Move-in Homes (“QMI”) that close on or before 4/30/26. The advertised Annual Percentage Rate (“APR”) of 5.162% APR is based on a Conventional 7/6 ARM, 30-year fully amortizing term, with a Total Purchase Price of $475,000 and a loan amount of $380,000, 20% down payment and 780 median credit score. The initial starting interest rate is 3.75% for 84 months, (Maryland and Pennsylvania must qualify at the fully indexed Rate). After the initial period, the variable interest rate and payment may adjust every six months and equal the total of the 30-Day Average Standard Overnight Financing Rate (“SOFR”) index (3.658% as of 2/9/26) plus a margin of 2.75%. The maximum change in the interest rate is up to 5% at the first adjustment, up to 1% every six months thereafter with a maximum lifetime adjustment of 5% (max life interest rate of 8.75%) and your payment will increase. Available for conventional conforming loan limits, owner-occupied only (minimum loan amount $225,000). Special Interest Rate Financing may change or not be available or funds may be exhausted at the time of loan commitment, lock-in or closing. This offer may change or be cancelled without prior notice. Promotion eligibility, buyer must: (1) pre-apply with KHAM by visiting K. Hovnanian American Mortgage, L.L.C. prior to offer; (2) and finance with KHAM; and (3) meet all other eligibility and closing requirements. Seller reserves the right to modify the above finance Promotion terms and/or Promotion Period at any time prior to contract. Buyer is not required to finance through KHAM however, Buyer must finance through KHAM to receive the finance Promotion. Interest rates and available loan products are subject to underwriting, loan qualification, and program guidelines. Credit scores/occupancy/property type can add additional buyer costs. Maximum seller contributions apply. Seller is not acting on behalf of or at the direction of HUD/FHA or the Federal government. Seller is not a lender. Offer and subject to all RESPA guidelines. This is not a commitment to lend. Buyer is subject to credit and underwriting qualifications, and investor program guidelines. Not available on all homes or in all communities or states. Cannot be combined with any other discounts, promotions, or incentives. Not all borrowers will qualify. Restrictions apply. Services not available in all states. K. Hovnanian American Mortgage, L.L.C. NMLS #3259|3601 Quantum Boulevard, Boynton Beach, FL 33426 (www.nmlsconsumeraccess.org) | KHOVMORTGAGE.COM. Licensed by Arizona Department of Insurance and Financial Institutions. Lic. #906585. ©2026 K. Hovnanian Arizona New GC, LLC; ROC 188563. ©2026 K. Hovnanian Arizona New GC, LLC; ROC 277023. Licensed by California Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Lic. #4130532. ©2026 K. Hovnanian California Operations, Inc. DRE license #01183847. Licensed by Delaware Office of the State Bank Commissioner to engage in business in this State. Lic. #7864 Expiration 12/31/2026. Licensed by Florida Office of Financial Regulation. Licensed by the Georgia Department of Banking and Finance #22272. Licensed by the Maryland Office of the Commissioner of Financial Regulation. Licensed by New Jersey Department of Banking and Insurance. Licensed by Ohio Division of Financial Institutions. Lic. RM.850228.000. Licensed by the Pennsylvania Department of Banking and Securities. Licensed by South Carolina Board of Financial Institutions. Mortgage Banker Registration issued by Texas Department of Savings and Mortgage Lending. Licensed by Virginia State Corporation Commission, Bureau of Financial Institutions Lic.#MC-2661. Licensed by the District of Columbia Department of Insurance, Securities and Banking. Licensed by the West Virginia Division of Financial Institutions. Where applicable, buying power estimates are based on calculation models from Associated Bank as of December 2025. Third-party website; not an endorsement. See a sales consultant for full details. Equal Housing Opportunity.